In the News: OSFI is implementing a bank-side rule, starting Q1 of 2025, that will limit how many uninsured mortgages they can hold with an LTI (loan-to-income ratio) that exceeds 4.5 times an applicant's gross annual income as rates drop. Read more about how this cap may affect your home-buying power here.

First-Time Home Buyers

There's no place like your (first) home.

Dream of owning? We dream of helping you get there — with your best rate, better mortgage, and simple, stress-free process. Download our free buyer's guide!

Your first home? Good thing it's not ours.

Take advantage of our deep mortgage experience. And lower rates, of course.

We've been doing this mortgage thing for over 17 years — and we've helped many first-timers out of their parent's basement or break the cycle of renting.

There's a lot to know, especially to save more. Is your bank going to help you with all that? Short answer: No. But we can, as one of Canada's top mortgage brokerages. We exist to offer you the lowest rates in the industry through volume discounts and strong lender relationships. Our highly trained, salaried, non-commissioned True North Mortgage brokers offer unbiased advice that puts you first. We have the freedom to check with all lenders to get you the best rate and mortgage fit for your situation.

Talk to us — we make it easy. It's free to get our help in your preferred language, with no obligation.

Apply now, schedule a call-back, give us a shout by phone or email, drop by a store — wherever you are in Canada, you'll get a fast response and unbeatable mortgage advice. It's why we have the most 5-star reviews in the business.

More than great rates, the type of mortgage you get really matters.

See an ultra, ultra low rate on the web? Guess what? The mortgage that comes with it may trap you with higher penalties or restrictions that cost you more money in the long run or at renewal time. For your first mortgage, it's important to get the right fit at the best rate so that it works for you over the long term.

That's where we come in — we know mortgages inside and out and can find the right one for you. If you go to your bank, you'll only get what they offer. We can check with all of them (plus our own THINK Financial) which means you can sleep easy knowing that you didn't miss out on a better option.

Need cash upfront? We can offer Cash Back Mortgages on both variable and fixed rates. Ask us if this option is right for you.

Your very first home is exciting, yet intimidating — here's how we make it easy.

Besides being a big commitment, it may be the single most important financial decision you'll ever make. That sounds hard, but we make the process easy and smooth, while saving you a pile of cash:

- Download our First-Time Home Buyer's Guide for help with your process from beginning to end.

- See your numbers with our designed-for-you mortgage calculators and other helpful tools.

- Apply online easily. Our form quickly funnels your questions to target your situation, and tells you what info you need to provide. Hit 'submit,' and we get back to you shockingly fast.

- Or, connect with us at one of our store locations or over the phone.

- Get an expert broker who can help you in your preferred language.

- Know that you'll get the best rate and mortgage fit, with unified, expert brokers who do all the haggling for you (we're very competitive on your behalf).

- Understand the difference between a variable and fixed rate, and what payment type you should start with.

- Get a real person who helps you, right to the end. In fact, we're with you when you first walk through your own front door (just kidding, but we're with you in spirit, doing a dance of joy).

Read more: Mortgage FAQs

Your first mortgage — there are programs and rebates to help.

We have great advice that may help soften the financial blow of your first home. With higher entry prices, especially in larger-centre markets, there are federal and provincial programs and rebates available:

- First Home Savings Account (FHSA) offers a tax free way to save and withdraw funds towards your first home down payment and buying cost.

- RRSP Home Buyers Plan (HBP) allows you to borrow from your savings to put towards a down payment, interest free.

- Federal First Time Home Buyers Tax Credit that can provide up to $1500 to put towards closing costs.

- Other federal and provincial tax rebates that may provide extra funds towards closing costs and GST/HST relief.

Feel free to talk to us even before you want to apply, to get the info you need. Then, when you're ready, we'll check with the lenders on your behalf and take you through all the options for your best financing solution. You'll get your mortgage approved at the best rate and most flexible terms.

Need a realtor? We can help with that too — with referrals based on our long-standing, trusted relationships within the industry.

You'll save thousands, giving you the best start for your very first home.

A smoooooth process, from beginning to end.

It's your first mortgage, but definitely not ours. You'll have peace-of-mind knowing that our highly-trained brokers use their insights to assist you through every step of your mortgage process, smooth as silk:

- Your Down Payment: When you first buy a home, the amount of your down payment can make a difference, though a borrower may go as low as 5% down if you have an excellent credit history. We can help you look into various strategies and programs to help fund your down payment.

- Your Pre-Approval: We quickly determine the mortgage amount and best interest rate for which you qualify, according to the latest federal stress-test requirements. Most True North Mortgage pre-approvals come with a 120-day rate hold (depending on the lender) — so when you start house-hunting, you have a good idea of what you can afford plus some time to find the perfect place. And make sure to do this, but not that to help ensure your pre-approval goes all the way to the finish line.

- The Purchase of Your Home: Make sure to include a condition day, and give yourself at least one week to finalize all financing. Don't forget to use the time to get a home inspection!

- Your Paperwork: Our mortgage broker will explain, in detail, all of the paperwork that the bank/lender requires.

- The Close: All paperwork will be sent to the lawyer of your choice.

When you first walk through your (own) door, you'll feel the joy of knowing that you got the best mortgage rate and fit, and that we're always here for you in the future (think mortgage renewal time!).

Other ways to get a helping hand.

Some Canadians are coming up with more creative strategies to get them into home ownership faster. Here are some topics that may interest you:

- Renting to own your home (read this blog for what to look for)

- Your Guide to Co-Ownership of a Home

- What's the difference between a guarantor and a co-signer?

- Multigenerational Mortgages

We regularly help first-time buyers with all of the above mortgage solutions.

Get expert advice to find your way home.

No matter where you are in Canada, expert mortgage help is a click or phone call away.

Get the mortgage help you need, right here.

More First-Home Resources

First-Time Home Buyer's Guide

Essential information, tips and worksheets to help make your first home a reality.

Learn More

RRSP Home Buyers' Plan

You can withdraw up to $60K from your RRSPs toward your first down payment.

Learn More

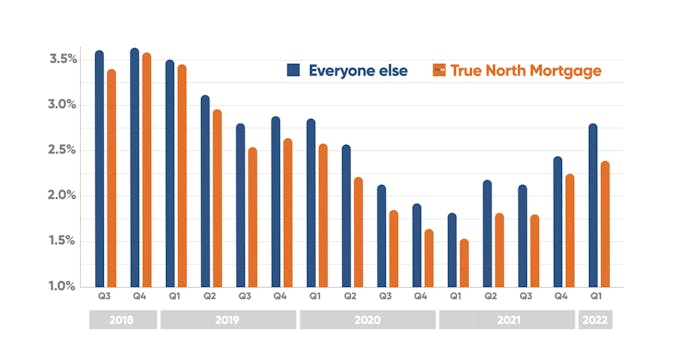

Proof that our rates are lower.

Our rates are 0.20% lower on average compared to everyone else. Prove it? Okay!

Learn More

5-Star Reviews

We care, and it shows — we now have over 15,000 5-star client reviews.

Learn More

Pre-Qualify in Minutes

Know before you go (house hunting, that is). Get pre-approved fast, hold your best rate.

Learn More

Variable vs Fixed Mortgage Rates

Which rate type works best for you, variable or fixed? Some pros and cons to…

Learn More

Credit 101

Take a closer look at how your credit works for getting your mortgage approval.

Learn More

Your Income

Your income matters for getting a mortgage. Here are some details.

Learn More

Mortgage Down Payments

Want to buy a home? You'll need at least 5% down. But wait, there's more.

Learn More

Closing Costs Calculator

Your closing costs are on top of your down payment — calculate them here.

Learn More

Purchase Plus Improvements

Need to renovate? Welcome to loan sweet loan. One manageable mortgage, one best rate.

Learn More

2024 Housing Stats

Get to know the latest Housing Market trends to inform your buying and selling decisions.

Learn More

Mortgage FAQs

Your mortgage is a big decision. Here's some info to help sort it out.

Learn More

What is an Insured Mortgage?

Insured mortgages can mean better rates and options. Here's how they work.

Learn More

Watch Out For Mortgage Traps

Is your spidey-sense tingling? Watch out! That bargain-bin rate may cost you more later.

Learn More

Do This, But Not That

Here are some things to know, to help get your pre-approval over the goal-line.

Learn More

Great advice for your new home build.

Important things to keep in mind when buying pre-construction.

Learn More