Be in the know! Check your credit for free through Equifax Canada or TransUnion — it won’t impact your score and can help you address or improve any issues.

Lowest Mortgage Rate in Canada. Starting from 2.49%

Credit 101

What is a credit score and why is it so important for your mortgage?

Your credit standing shows your track record for paying bills and helps lenders assess your default risk. Here's how it works, and how you can improve your score to save more.

A closer look into your credit and credit score.

Your credit standing can have a big impact on your mortgage application. All lenders have a minimum credit score they'll accept — big banks and alternative lenders may use different minimums to assess your ability to pay on time.

Good credit can help you access additional benefits to reach your financial goals sooner:

- Better rates on an insured or conventional mortgage

- More lender and product options for your best fit and savings

- More likely to get mortgage approval through your lender of choice, qualify for a higher amount (depending on other details, such as income source), or have an exception granted (every situation is unique)

What is a credit score?

Your credit score and rating are produced and compiled by Equifax or TransUnion, the two main credit bureaus in Canada.

A number called your 'score' represents and helps you estimate your general credit position. Your reported debts and related info (e.g. payment type or frequency) are also collected to give banks and other lenders additional info to assess whether or not you're a good (low) credit risk.

Crunching numbers to produce your score.

FICO scores (mathematical formulas created by Fair Isaac & Company) or Pinnacle (formerly Beacon) scores are calculated by Equifax and TransUnion. They crunch the numbers from reporting credit sources and spit out a score between 300 and 900:

- The lower your score, the higher the perceived credit risk.

- A score between 680 and 900 is considered good, very good, or excellent.

- A score of 700 or higher helps to put you in the financial driver's seat.

What credit score does your mortgage lender use?

If you look at your credit score from a credit bureau, you're likely seeing your Pinnacle score.

Mortgage lenders, however, use your FICO score for your application approval, which isn't publicly accessible (only through your mortgage broker or lender) and can be lower based on its gathering and scoring methods.

If your FICO score is lower, it doesn't necessarily affect your mortgage approval, but it may catch you unaware if your credit is on the cusp of receiving approval from a lender.

Do you need a credit subscription?

Both Equifax and TransUnion are legally required to allow you to check your credit score for free in Canada. However, they also offer paid subscriptions or apps with anytime-access to your score and file.

While the paid service may be overkill (and an extra cost you don't need) just to be able to check your score, a subscription can help monitor for identity theft — with alerts that tell you if new credit has been opened in your name.

When it comes to your credit, some things are in your control — and some aren't.

In your control:

- Knowing what's in your credit file can help you understand how it will affect your mortgage loan application

- Budgeting and striving to pay bills on time

- Working with a mortgage broker, lender, or credit advisor for a solution if income is interrupted

- Updating your credit file if there's a mistake

- Taking immediate steps to repair your credit, if needed

- Informing your mortgage broker about the state of your credit and any issues that may exist

Out of your control:

- How credit bureaus collect and calculate your credit score

- The minimum credit score a lender uses to qualify your mortgage application (though other application factors may work in your favour)

- How long it takes for credit bureaus to factor in the latest changes (from 30 days to a few months, depending on the change)

- If your credit score is too low, your options will be limited — you may not receive a mortgage approval that works for your budget (though you can work to improve it over time to try again)

Our friendly, expert brokers can help you take effective steps to improve or address your credit. They have deep experience and understand that everyone can face challenges. And if you have good credit, they can offer extra tips and good-to-know info to help you stay there.

Understanding your Credit Bureau Report

Here are the factors Equifax or TransUnion considers when calculating your credit score, with an estimate of how heavily each factor is weighted.

The higher your FICO or Pinnacle score, the better your credit rating. The purpose of this score is to provide lenders with a prediction as to the credit risk you represent based on your past behaviour.

Here is what your score is based on:

1. Past Performance – 35%

- The fewer late payments you make, and the fewer judgments, liens or collections you have, the better.

- Late payments are time-sensitive. More weight will be given to recent late payments than those two years or older.

2. Outstanding Debt/Credit Utilization – 30%

- Low balances on several cards are better than high balances on a few cards.

- It is ideal to keep the maximum charged to the credit cards at or below 60% of the available credit. Your score will be adversely affected once you exceed 80% of the available credit on your cards.

3. Credit History – 15%

- The longer the credit accounts have been open and in good standing, the better.

4. Types of Credit in Use – 10%

- Finance company accounts, such as BestBuy and HBC cards, usually score lower than traditional banking or retail accounts.

- Deferred payment options (e.g. buy now, pay later) are interpreted as a potential future risk.

5. Inquiries – 10%

- Having too many inquiries over a short period of time may be perceived as 'shopping for credit' and be flagged as a higher-risk profile.

- If you already have a good credit score, regular inquiries will have little to no effect on your score.

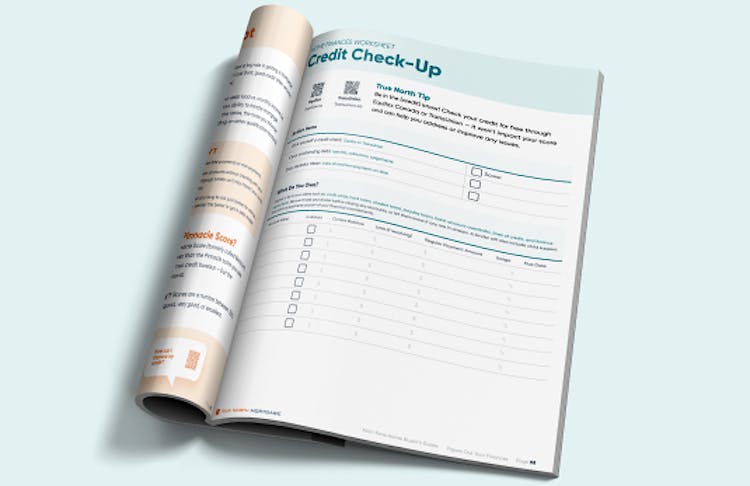

Ready to give yourself a credit check-up?

Our First-Time Home Buyer's Guide takes you through the entire home-buying process, clearly and easily.

It’s full of essential info, tips, and worksheets, like this Credit Check-Up, to help make your first home a reality.

Download our guide to get this worksheet and everything else you need to know (it’s free!).

How good is your credit score?

Here's a deeper dive into what the numbers mean — it's not who you are, but how you pay.

- Credit scores range from 300 to 900 with Equifax and 300-850 with TransUnion.

- The average consumer has a score of 650 to 725. A score over 760 is considered excellent.

- Most prime lenders require a score of at least 660 for a purchase or 680 for a refinance. Some lenders may allow exceptions down to 600 on very strong applications.

- Alternative and private lenders have varying minimum scores; some will go down to 550 or 500, and others may have no minimum score requirement — instead using other application details for your loan, like home equity.

Your net worth or annual income is not part of your credit score calculation. There's no fundamental reason why a groundskeeper should have a lower credit score than a surgeon.

Contact both credit bureaus if you find an error.

The reporting system is imperfect, so it's important to periodically verify the information on your credit bureau report. If you find an error, you can take steps to dispute an item on your file.

It may be necessary to contact both Canadian credit bureaus, as they don't work together or communicate to share your file details.

- File a dispute with Equifax Canada

- File a report with TransUnion

For more info about Credit Reports, please see our Credit FAQs.

What can you do to build or improve your credit score?

- Pay your bills on time. Delinquent payments and collections can have a major negative impact on a score.

- Keep balances low on credit cards and other 'revolving credit.' High outstanding debt can affect a score.

- Apply for and open new credit accounts only as needed. Don't open accounts aiming for a credit mix — it probably won't raise your score.

- Pay off debt rather than moving it around. Also, don't close unused cards as a short-term strategy to raise your score. Owing the same amount but having fewer open accounts may lower your score.

- Ensure the information in your credit report is correct — checking your own credit report doesn't affect your score. If you find errors, contact the credit reporting agency and your lender.

Can you repair damaged credit?

Yes, you can repair your credit! Many people, however, find it difficult or time-consuming to tackle on their own.

Ask a professional advisor to handle your debt consolidation process — choose one who doesn't charge for this service. For example, an expert True North Mortgage broker or an advisor with your current lender should be able to help at no cost to you (though fees may be involved in a mortgage solution to rehabilitate credit).

If you've filed for bankruptcy, your file may require additional help (and time) and incur professional or admin fees to get back on track.

We recommend debt consolidation over bankruptcy. In most circumstances, the best course of action is to bring your debts together under one payment at a lower rate, which can lower your monthly amount owed, and help you gain traction on repayment and re-establish control over your finances.

Bankruptcy - the hard way out

Filing for bankruptcy has very serious consequences. Once you have filed for bankruptcy, your credit bureau will carry this record for at least six years, making it very hard to re-establish your credit. Additionally, your bank will likely not loan you money again (ever) if they have suffered a loss due to your bankruptcy filing.

Certain lenders provide mortgages for clients who have been:

- Discharged for 2 years, and;

- Have at least 1 year of re-established credit with 2 methods of trade (a credit card and a loan, or 2 credit cards).

After bankruptcy, it can be a challenge to re-establish your credit. The best path forward is to get a secured credit card. A secured credit card requires you to provide funds upfront to the credit card provider. If you default on the credit card, the credit provider keeps these funds. Make sure the one you use actually reports to the credit bureau (not all do).

Re-establishing credit

To apply for a secured credit card that reports to credit bureaus, visit Capital One for their process.

For more information about your Credit Rating, how to manage or improve your score, and what factors may affect it, check out our Credit FAQs.

When do we pull your credit? A hard check (that records a minor and temporary effect on your credit score) is needed for your mortgage pre-approval — a pre-qualify is considered a soft check. It allows us to shop lenders for your best rate and product — and to hold your rate for up to 120 days (depending on the lender). We don't access your credit until you provide consent!

Want great advice for good credit?

Good credit standing puts you in more control of getting a mortgage approval at a better rate.

We're here to help you. Our expert True North Mortgage brokers can offer targeted strategies to improve your credit score — to help you get your best mortgage rate and product and potentially save thousands.

You'll also gain a wealth of knowledge about how lenders see your application, whether you're a first-time buyer, thinking of your next home or need a renewal or refinance.

Have more questions? Anywhere you are in Canada, we can quickly help determine your situation — online, over the phone or at a store near you.

Friendly brokers who care, for a better mortgage experience.

We know mortgages, here's more

Credit FAQs

Have credit questions? Here are some quick facts you should know.

First-Time Home Buyers

Get the best start and save a pile of cash with our mortgage experts.

Your Employment Income and Mortgage Approval

From paycheque to your mortgage approval, here's how lenders view your income.