Did you know? OSFI (Office of the Superintendent of Financial Institutions) is a federal banking regulator in charge of keeping Canada's banking system one of the most secure (if not the most secure) in the world.

Its regulations and bank guidance aren't always popular with home buyers and owners, and other players in the mortgage industry who advocate on their behalf.

Lowest Mortgage Rate in Canada. Starting from 2.49%

A new loan-to-income cap? How it might affect you.

Planning on buying a home soon? You may need to adjust your 'dream' home expectations.

The new LTI regulation may not affect every mortgage approval. But be forewarned — it might shrink what you can borrow and further diminish single-home ownership in Canada.

The case of 'The Shrinking Home'?

Are you hoping that if (when) rates fall, you'll be able to afford 'more' home? The latest OSFI regulation may interfere with your plans.

Starting Q1 2025, a new loan-to-income (LTI) cap is aimed at preventing banks from 'overlending' to 'overleveraged' home buyers wanting to take advantage of falling rates to buy a bigger and higher-priced home.

The LTI measures your loan amount against your gross annual income. The new cap will limit the number of mortgage loans a bank can hold with an LTI over 4.5 times a borrower's income.

For new home purchases (not existing mortgages or renewals), this rule could have the biggest impact on first-time buyers trying to break into the market, who currently face steep home affordability challenges.

Here's the possible impact on home buying in Canada.

"Highly leveraged loans in the banks’ residential mortgage portfolios ... have ballooned alongside rising prices to make Canadian borrowers among the most highly indebted in the world."

– The Globe and Mail, Mar. 22, 2024

Only for uninsured mortgages (so far).

OSFI really likes protecting banks from the risk their uninsured mortgage portfolio poses.

Unlike an insured mortgage, which is government-backed and can't fail and ding a bank's bottom line — uninsured mortgages carry a higher risk of default.

So, this new regulation piles on this mortgage cohort, meaning that if you buy a home with at least a 20% down payment, you may face this LTI limit if your bank has reached its LTI-cap ceiling. Also of note is that all loans against the property are included in the calculation, such as second mortgages and lines of credit, as well as mortgages on other properties you own.

Making enough to buy a home?

The LTI measure may become more of an issue in challenging housing markets, like Vancouver, Toronto, and even Calgary, where homes are more expensive, and some potential buyers have, in the past, needed to borrow more than 4.5 times their income to get their foot in the real estate door.

Yet, home prices aren't necessarily 'inexpensive' in other Canadian centres. Salary levels are often tied to the supply and demand of the local economy, which can also feed into the level of average home prices, making 'expensive' relative.

Statista states, "Between 2015 and the fourth quarter of 2023, house prices had outgrown the nominal disposable income by 39%."

Income levels are already a significant issue for many Canadians trying to afford a home.

The Shrinking Home? Some LTI evidence.

This regulation is on the bank side, so will you ever really see it?

Right now, it's unclear how quickly banks may reach their OSFI-imposed quarterly cap or what the 'penalties' are for banks if they overreach it during a particular quarter.

If there's overreach, the next quarter will likely require a lowered cap to compensate. But that's private information — no bank will publicly share operational details (nor will OSFI).

OSFI says the LTI cap will be imposed differently for each bank based on the portfolio history and management process.

Home buyers may not be aware if big-bank mortgage rates offered to them are more expensive or their applications are being rejected due to this regulation.

Does your application fall outside the new 4.5% LTI measure? You'll probably pay more.

Ultimately, this new bank LTI rule means there is more potential that banks will charge you higher uninsured rates if your LTI exceeds 4.5%. A higher rate helps the bank monetarily hedge against the uninsured mortgage risk (of default) and balance the books in light of the OSFI cap.

Or, if the regulated banks say 'no' — whereas before the LTI test, they would have said 'yes' — a mortgage solution with an alternative or private lender might be your only option, but it will cost you more in higher rates and fees.

Loan-to-Income Cap: Who Benefits?

Winners

Those who make more or own more are most likely to benefit from the cap through lower rates or exemptions.

- Financially stronger applicants – Good credit, steady income, lower debt

- Higher-income earners

- Insured borrowers – Less than 20% down is not subject to LTI-cap rules

- Investors – High net worth individual with private banking privileges that can get favoured deals

- Banks – It would be prudent to charge higher rates on any applications over 4.5% LTI that they do accept

- CMHC – More insured mortgage business from home buyers avoiding the uninsured LTI cap

- OSFI – Waving Canada's 'most-secure banking sector' banner (not a bad thing)

Potential Losers

Buying a home will be costlier or out-of-reach for some, pushing more Canadians to rent for longer (or forever).

- Many first-time home buyers who already face affordability challenges

- Next-time home buyers who may not qualify for the home they want, even with equity built up

- Home buyers in higher-priced areas (such as Toronto and Vancouver)

- Those who have a 20% down payment saved may opt for an insured mortgage instead (and pay the insurance premium)

- If rents stay high due to demand, renters may have an even harder time saving enough down payment to own a home

"In 2011, multiple-property owners accounted for 15.3% of home purchases, but by 2022 their share of the market reached 25.2% of all homes sold in the province of Ontario."

–The Globe and Mail, Mar. 22, 2024

The case of 'Canada's Shrinking Homeownership.'

The 4.5% LTI measure can potentially put more homes in the hands of fewer Canadians.

As rates go down, investors (who invested heavily during the pandemic while interest rates remained at all-time lows) will be back in the market for houses as the rental market stays hot (from recent record immigration, high home prices, and a chronic lack of housing inventory slated for years to come). From 2011 to 2021, the number of households who rent the home they live in increased by more than 21%.

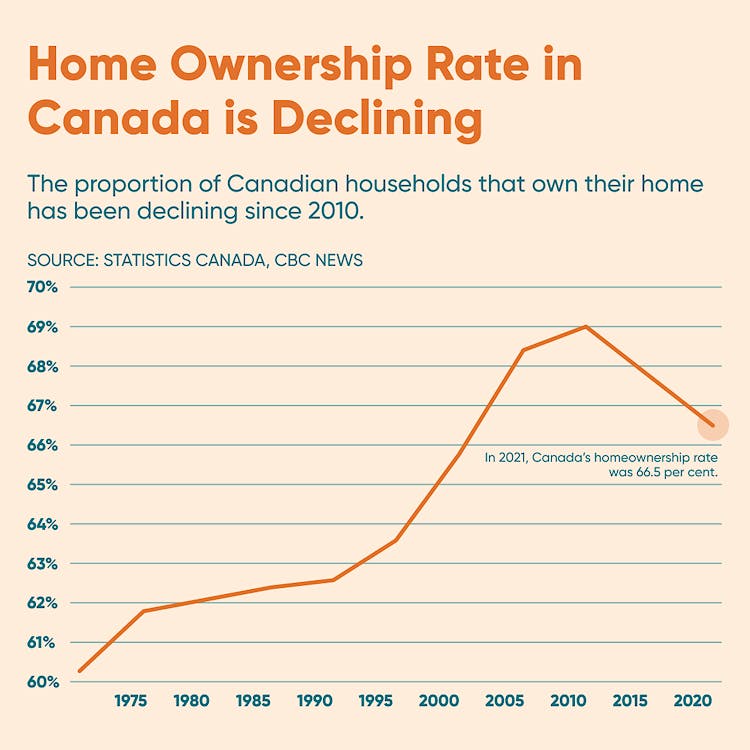

The LTI cap could shut out more lower-income buyers, which would add to an already concerning trend of declining single-property owners — which had climbed steadily to 69% between the 1970s and 2010 but has since declined to 66.5% in 2021 — presumably due to rapidly rising home prices and more recently, the rapid rise of interest rates.

Need home-buying strategies to help 'unshrink' your home amount?

- Go for the insured mortgage. An insured mortgage (less than 20% down) gets you out from under the LTI cap. But, you'll need to pay an insurance premium even though yreceive a lower rate than an uninsured mortgage)

- Ask for that promotion. The more you make, the more home you can get approved for.

- Save longer for a larger down payment. For a reduced LTI ratio.

- Team up with family or (vetted) strangers to strengthen your application and add applicants' income to improve the LTI ratio.

- An alternative (or private) lender may be an option. Lenders that aren't regulated by the federal government or have higher LTI limits may charge higher rates and fees, but they could also offer a viable short-term mortgage solution to help you start your journey, allowing you to renew into lower 'traditional' rates later.

How can you improve your mortgage application to aid successful approval?

The LTI rule means that banks will likely more closely scrutinize home purchase applications.

If you're concerned that you may be in the more 'leveraged' category and you want to help improve your application, our friendly, expert brokers can help you strategize.

Stronger application details can include:

- Good credit (a score of 680 or above)

- Strong and steady income sources readily verifiable

- Lower other overall debt (a lower TDS ratio)

- Multiple applicants that have strong financial details

- Higher-income earners

- A bigger down payment that lowers your LTI

We expand your ability to save more.

If ever you needed a helping (mortgage) hand, that time is now (and yesterday, and tomorrow).

Our highly trained brokers know the mortgage industry in and out. We can source your best mortgage solution, your best rate, and your best strategy to help realize your homeownership dream.

Give us a try, anywhere you are in Canada. Over 17,000 happy clients have given us glowing reviews (the most in the industry, by far), so it must mean we put you first (we do).

Unbiased advice and your best mortgage rate.

More dream (home) advice

First-Time Home Buyers

Get the best start and save a pile of cash with our mortgage experts.

Pre-Qualify in Minutes

Know before you go (house hunting, that is). Get pre-approved fast, hold your best rate.

Mortgage Stress Test: What is it and how does it work?

You have to be able to handle higher payments as a buffer for affordability.