Lowest Mortgage Rate in Canada. Starting from 2.49%

It's a quadruple hike from the BoC

The central bank hikes its benchmark rate by 1.0%, bringing it to 2.50%.

We haven’t seen these rates since 2008, and it's the largest single increase since 1998. The latest 'low-rate' era is officially over.

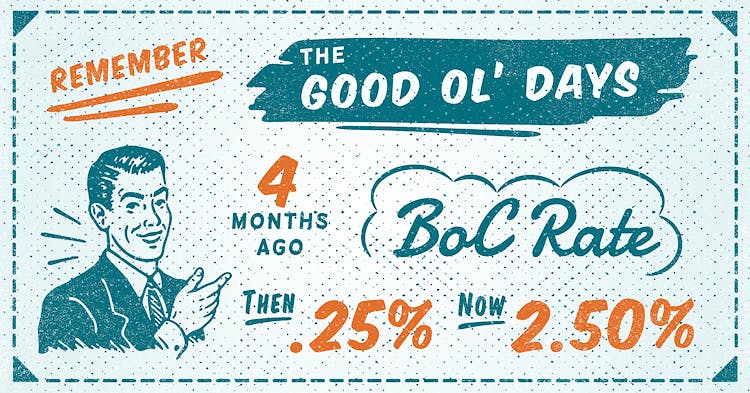

Feeling nostalgic for the low-rate days?

Remember when the overnight lending rate was 0.25%? Sadly, it wasn't that long ago. The BoC's benchmark rate, which affects variable-rate mortgages and HELOCs, has gone up a full 2.25% since March 1. That should bring prime rates to 4.70% (not including lender discounts off of prime). If you hold one of these products, this is the fourth (rather hefty) rate hike you've weathered in as many months.

Experts adjust their rate sentiment.

Since our Mortgage Rate Forecast 2022 blog release (June 1), things have changed. Shortly after that last hike, experts pushed their BoC 'neutral rate' projections towards 3.25%.

Fixed rates then increased in anticipation and have already (mostly) priced in today's quadruple-hit of 1.0% (0.25% is considered a single raise). We wait and watch to see if these aggressive hikes are enough to tamp inflation without tipping Canada into a recession.

It's not all doom and gloom.

Inflation has been rising like an escaped party balloon. The Bank of Canada (BoC) is pushing through these rapid rate increases to catch hold of inflation before it gets out of reach and does more damage, for longer.

The central bank's sole focus right now is to bring down inflation — regardless of any effects that may have on the housing market.

– Dan Eisner, True North Mortgage Founder and CEO

Since the rate hikes began, housing markets across the country are slowly returning to a more balanced state. Sales are slowing, and prices are de-inflating from their previous historic highs — especially in the larger city centres where home affordability has been a major impediment for first-time home buyers.

Rates couldn't stay as low as they were forever. And home prices rose too quickly. Higher rates are something that we, as a nation, look to weather for the next year or two as the markets attempt to recover from pandemic shock and global volatility.

And if these fast rate hikes dunk our economy into a recession? Then rates will need to come down again — which has happened with every past rate-increase cycle.

Last but not least, we have many ways to help you save cash or free some up. Our highly trained brokers can suggest the best strategies to work your mortgage to the max. Read more here or give us a shout today.

What does today's increase mean for your variable-rate mortgage?

This super-sized hike means you're weathering another increase in your mortgage payment to cover the higher interest costs.

For example, on a $475,000 mortgage, you'll be paying about $240 more per month since the last hike (June 1).

If you happened to qualify for our lowest rate back when it was 0.99%, your rate would now be 3.24%, meaning you're paying an extra $519 per month since these rate hikes began.

Thinking about changing your payment frequency to get ahead of higher rates? Read all about it here.

Time to switch to a fixed rate?

Canadian homeowners who previously chose a lower variable rate over a fixed one because of the wide spread may wonder (and worry) if it's time to switch.

It takes only minutes for your expert True North Mortgage broker to run the numbers. As rates climb, you'll get your best savings scenarios for your peace of mind.

Hit pause on rising rates.

Variable or fixed, if you're thinking of buying soon, we can hold your best rate for up to 120 days. For a variable rate, a hold ensures that you retain the lender discount (off of prime) while you take the time to decide on your next (mortgage) move.

We've got that old-fashioned, great-service thing going on. Wherever you are in Canada — give us a call, apply online, start a chat or drop by a store location. You'll be glad you did.

Great service never goes out of style.

We really know mortgages, here's more

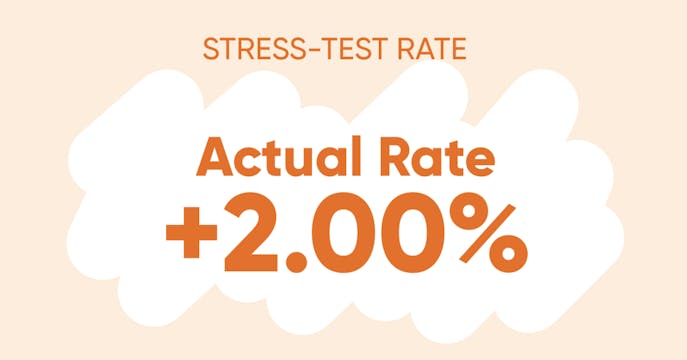

Say goodbye to your stress test rate of 5.25% in 2022

'Home' much can you afford? Your higher qualifying rate may have an impact.

Watch Out For Mortgage Traps

Is your spidey-sense tingling? Watch out! That bargain-bin rate may cost you more later.

5-Star Reviews

We care, and it shows — we now have over 17,000 5-star client reviews.