What's the current state of the prime rate?

Canada's prime rate last dropped in October 2025 (following another Bank of Canada policy rate cut) by 0.25% to 4.45%. Current rate forecasts indicate a pause in further rate cuts that could last through much of 2026 — with the potential for a rate hike later in 2026 if inflation heats up.

Any forecasts, however, greatly depend on the outcome (or continued uncertainty) of U.S. trade negotiations. About 90% of goods exported to the U.S. are currently protected under the CUSMA (Canada-US-Mexico Agreement) framework, which expires in June 2026.

What are the benefits of a variable rate?

Variable rates are typically lower than fixed rates on any given day (e.g. during 'normal' times versus during a pandemic fallout) and carry some 'historical' savings weight, making them a favoured choice for less risk-averse mortgage borrowers.

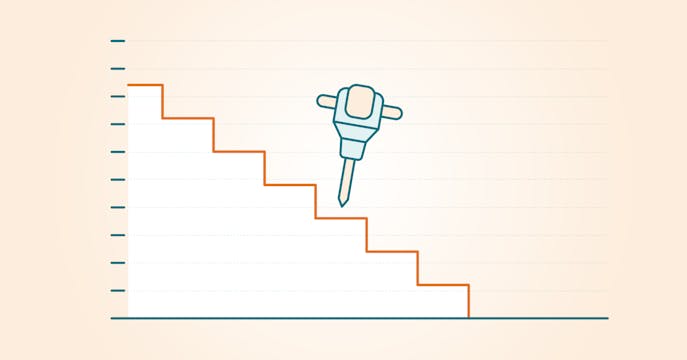

Post-pandemic, this rate type increased by the equivalent of 19 rate hikes (0.25% increments) from March 2022 to June 2024 — an economic anomaly that brought rates to a 22-year high. Since then, variable rates have declined back to typical levels, shifting the narrative back to the benefits of this rate type.

Some variable-rate benefits are:

- A better rate — a 5-year variable rate is usually lower than a 5-year fixed rate.

- Instant budget relief with each variable rate drop by the Bank of Canada — if you choose an adjusting-payment variable mortgage (ARM).

- Or, your amortization is reduced with each rate drop, helping you pay off your mortgage faster — if you have a fixed-payment variable mortgage with a big bank (VRM).

- Netting out savings during the rate ride — prime rates may rise and fall during your term, but you may still come out with savings.

- Long-term savings — a variable rate tends to save homeowners more over the life of a mortgage.

- The flexibility to lock into a fixed rate at any time, penalty-free (check whether your lender offers this option).

- Lower penalty than a fixed-rate mortgage if you decide to break your term.

Do variable rates still have room to fall?

True North Mortgage CEO Dan Eisner agrees with many economists that the prime rate will only fall again in 2026 if Canada enters a recession, or trade impacts growth and unemployment rates more substantially over time.

There are a lot of 'ifs' and 'ands' right now, and rate forecasts are subject to change, as economic conditions remain volatile.

What is a variable rate discount?

When you choose a variable rate, you'll notice it's expressed as a reduction off the prime rate (e.g. P -0.85%).

This discount off prime is how lenders compete for your mortgage dollars, and it can vary among lenders. The size of a discount offered to a borrower can depend on mortgage application details, such as income source and credit score, as well as whether the mortgage is insured or uninsured.

A word of caution — a bigger variable discount may hide other costs that are charged to make up for a 'low-rate' deal, like a more expensive monthly vs. semi-annual compounded rate.

Does your variable rate discount change during your term?

Once you lock into a variable-rate mortgage, your discount doesn't change.

Your mortgage rate will rise or fall along with the prime rate. But the discount itself remains intact.

If you're considering a variable rate, could the advertised discount shrink?

Yes, a lender may change its lowest advertised discount for a 5-year variable rate at any time, though it's usually market-dependent — for example, if the economy worsens, lenders may reduce their discount to address rising operating costs.

If you get a rate hold, your discount is usually safe during the specified hold period (which can differ by lender).

Are variable rates lower than fixed rates?

Yes, today they are. But in fact, this normal spread relationship has only recently returned. When prime rates rose post-pandemic to a 22-year high between 2022 and 2024, variable rates were above fixed rates, which is an unusual state (we called it the rate upside-down).

Variable rates are usually lower than the 5-year fixed rate by a spread of 0.25 to 1.0%. During the pandemic, as the prime rate quickly lowered in response to the economic crisis, this spread increased to around 1.5%.

A 'normally' lower variable rate compared to a fixed rate is a primary reason homeowners choose this rate type, which helps them save on their monthly mortgage payments.